Why WeChat is Going to Win the Instant App Battle in China

This post comes courtesy of our content partners at TechNode.

To great anticipation, WeChat rolled out Mini Programs – embedded instant apps – in January this year. As a major feature release, the buzz surrounding the Mini Programs piled up months before its actual launch. Discussions among industry insiders went from the actual form of Mini Programs to its potential to disrupt the traditional app store paradigm.

In contrast to the mounting buzz around Mini Programs, the feature only received a lukewarm reception in the first few months after its initial launch. Sobering reports detailed users and developers’ negative views in the first month. Upbeat sentiments toward the model soon shifted to skepticism about its validity.

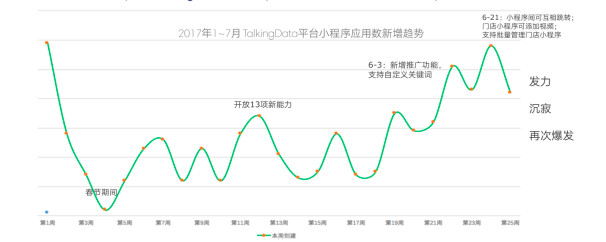

Ten months after the launch, it seems that Mini Programs are finally on track to healthier growth. The Mini Program user growth rate peaked at 96.3 percent in April. The figure slumped in May, but returned to moderate but rational 40 percent-ish growth in the following three months, a report from data analytics service TalkingData shows.

In the first seven months, the total users of WeChat Mini Programs increased by over 13 times, the report pointed out. At the same time, people are spending more time on the feature from 1.6 minutes in February to 3.6 minutes in July, showing that people are getting used to them.

The sustainable growth is winning back the hearts of users as well as developers. After hitting a low in the first month, the number of Mini Programs is growing steadily.

Given the market shift, TechNode talked with Zhang Xiang, CEO and founder of Mini Program developer Feeyan, on trends in the Mini Program industry. Founded in 2017, the Beijing-based startup helps users to develop customized Mini Programs. It now provides services for clients in a variety of industries including hospitality, automobile, tourism, real estate, and more.

Why a bumpy start for WeChat Mini Programs?

Expectations for WeChat Mini Programs were way too high before the launch and people got disheartened too quickly when its performance failed to meet all their over-inflated expectations, according to Zhang Xiang.

“When we take a second thought, this shouldn’t be the case for an emerging industry like Mini Program, where we have no successful examples to follow. When WeChat official account was rolled out, it [took] around a year for the firm to record substantial growth from the feature. Likewise, it’s unrealistic to expect Mini Programs to shoot to huge success in a few months,” he said.

READ: WeChat Profile Changes Banned Ahead of 19th National Congress

Zhang believes there’s a lot of opportunities to explore because what fueled the high expectations previously still holds water now. WeChat, as the most popular chat app in China, claims near 1 billion monthly active users. The vast user base of this monster app appeals to smaller companies and startups. Within the app, new companies should have an easier time being discovered, as well as engaging and monetizing the communities.

Another reason for the bumpy start is that WeChat didn’t open its full capacities to the public at first, providing but limited access and support to other services in the WeChat ecosystem. It’s a legitimate choice for WeChat as a move to test the market.

Tencent is developing the product at its own pace to give full functionality to Mini Programs, such as launching advertising bidding and allowing official accounts to create their own Mini Programs. Now, the firm has released a score of new features to make it more accessible “As of now, over 50 access points were opened through integration with official accounts, chat groups and more," Zhang emphasized.

Multiple big companies are entering the market, who’s going to win?

While WeChat is pioneering the new business model, several trendsetters in China’s tech field are trying to play catch-up. In response to WeChat, Alipay started its own instant apps in September. Xiaomi took the wraps off Direct Service function, a non-install instant service feature, in its MIUI update. Actually, the technology for instant apps is nothing new: Baidu launched Light App back in 2013 using the similar technology.

READ: It's Official, WeChat Really Is Watching You

For Zhang, the question of winners boils down to the following criteria: the size of the Super App’s original user base, its offline existence, and payment capability. Designed to be a tool to connect the online and offline world, payment capability is a critical link to complete the business loop.

Comprehensively speaking, WeChat now enjoys an edge among competitors in these regards, according to Zhang: “Billion-level monthly active users coupled with nearly 30 million official accounts, WeChat has an advantage for pioneering Mini Program service with its strong user-acquisition capabilities and the support from WeChat Pay.”

Compared with WeChat, both the pros and cons for Alipay to run Mini Programs are obvious. As the default payment tool for most Chinese people, Alipay’s force lies on its strong existence in the offline world. However, a payment-only tool will have lower user visiting frequency and doesn’t have the advantages of a mature social chain and traffic source, as is the case with WeChat, Zhang explained.

“For Xiaomi, they have their own ecosystem. In terms of user base, MIUI, the operating system, has over 100 million users, in addition to users gained through its smart hardware services, text messages, and browsers. But it has neither the social attributes nor power of a payment system to form a complete business loop,” Zhang commented.

READ: The Rise of China’s Cashless Society: Mobile Payment Trends in 2017

Baidu launched a similar feature, Light App, as early as 2013, but the concept didn’t really take off then. “PC still account for a major source of Baidu’s traffic. Relative weak user stickiness on mobile terminals combined with the lack of powerful payment system lead to the fail of their business.”

Mini-programs by sector

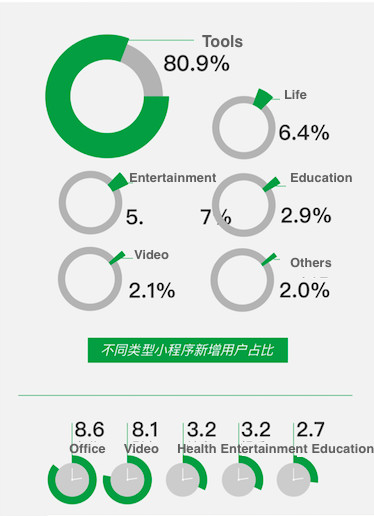

The discussions about which sectors fit better in the Mini Program business model have been around since the idea of instant apps was floated. TalkingData’s report shows that tools, video, and entertainment services stood out in terms of Mini Program user growth. Office and video Mini Programs stood out with an average user retention time of over eight minutes, far higher than the others.

“Similar to native apps, instant apps are applicable to every vertical. But for the time being, tools, like the ones for weather forecast or ticket sales and O2O lifestyle, are taking the lead. Mini Programs promoted by WeChat such as Mobike and fresh e-commerce platform Beequick are lifestyle services,” Zhang told us. In addition, Mini Programs' potential to foster online retailers is expected to be a growth point for Tencent, who is trying very hard to elbow into the home turf of Alibaba in e-commerce. “Traffic is an important aspect in e-commerce. Tencent has benefited a lot through WeChat-based micro-shops. I think there’s a lot of opportunities if they can attract these online retailers and combine them with offline stores through Mini Programs,” Zhang said.

Images: ifanr.com, Talking Data