How To Register for Your Individual Income Tax Refund in China

Editor's note: Tax season is upon us! The time to file income taxes for all Beijing residents – Chinese and expats included – runs until Jun 30. The following article provides information on how to register to file your taxes if you haven't done so in the past.

Bring up the topic of taxes and you’ll hear a collective groan. Not because people disapprove of the institution per se, but because it’s inevitably a headache that takes a lot of time from our schedule. And, while it was easy to skate by without registering for taxes if you were an expat prior to 2020, those days are long gone thanks to a policy implemented that year requiring all employees residing in China – be they foreign or Chinese – to register and file taxes.

In the case of the IIT (Individual Income Tax) for working in the People’s Republic of China, however, it’s more legwork and app work than paperwork. But, in order to use the app to file for taxes, you'll need to register with the Tax Office first.

I went to this one in Chaoyang: 朝阳区税务局第四税务所 cháoyángqū shuìwùjú dìsì shuìwùsuǒ. This is what I typed into DiDi and it dropped me off in front. They’re open Mon-Fri 9am-noon, and 2-5pm. Other locations can be found on this website.

Go to the right place. Or rather, the left place. Pass the gate pictured above and into the building on the right. Once you go through security, scan your Health Kit, and receive your very own pair of disposable plastic gloves, then turn left and find a line.

This is just the line to get your number before waiting in another line. Show them this screenshot and message: 我需要注册码来注册我的个人所得税APP wǒ xūyào zhùcèmǎ lái zhùcè wǒde gèrén suǒdéshuì APP, loosely translated to “I need the registration code to register my personal income tax app.”

Once they've helped you input your info, you'll be able to get a number. Be sure to listen to the intercom and check the screen (image below) while waiting to be called. You’ll get a number with an extra “0” in it, but rest assured, when you see your number minus the zero, it is your time. Walk past this sign, show your number to the nice guard, and proceed to your station.

Know your company name in Chinese and your name in the tax system. The order and correct spacing/capitalization of your name (typically last name, first name, middle name – but not always) must match all records, including your bank account. Just to be extra sure, check with your bank and company HR before you go to the tax office.

Once your number is called, the staff there will guide you through each step to register. We had no issues with the process, especially if the app is already installed, but you’ll need to have handy:

- Name as it appears on your employment records (always input your name in all caps).

- Passport*

- Phone number

- Your address in Chinese

- How many days you lived in China for the last year and the year before

*Note on passports: if you've gotten a new passport since you last filed your taxes, bring the old passport with you when registering. If you only bring your new passport, you'll be asked to bring the old one, thus meaning you'll need to make two trips instead of one to get this process done.

The trickiest part was that you need to create a password, and it must have at least one capital letter, one lowercase letter, and a special character. This was only tricky because the instructions were hard for the staff to understand since the Roman alphabet requirements don’t translate exactly right. But we had a good laugh about it.

Then the staff will show you how much of a refund you will get, and take you through the steps of inputting your bank account information. After that, you’re done and should receive the refund directly in your account.

When and if you do get all this complete, then you'll be able to use the Individual Income Tax app (个人所得税 Gèrén Suǒdéshuì) to file your taxes.

It should be noted, though, that once you get your code, you'll have seven days to use it to file taxes and get your refund information.

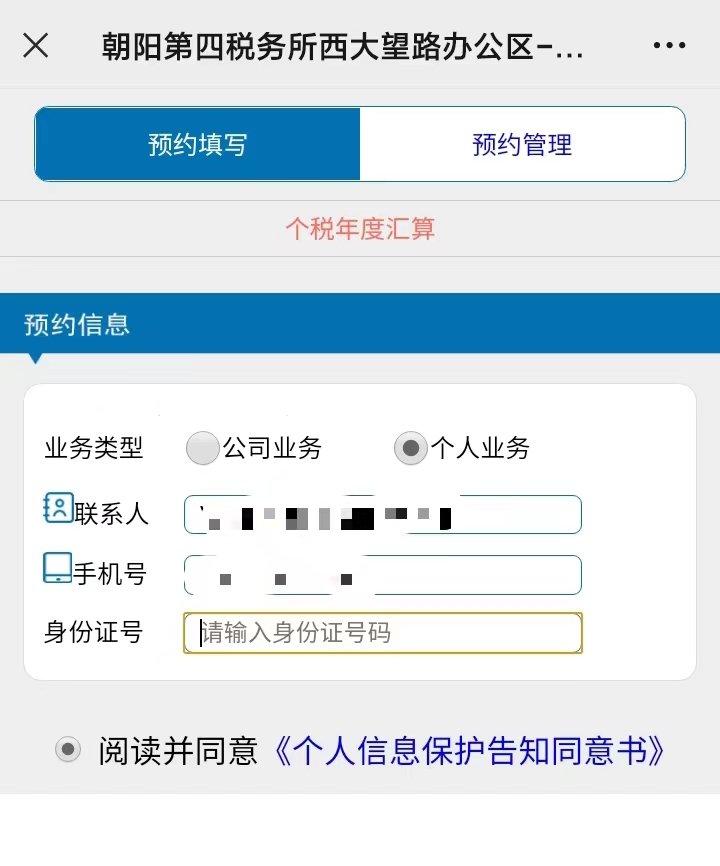

If you do decide to schedule an appointment, it's important to note that, if you miss two scheduled appointments, you won't be allowed to schedule a third, so best to save the date.

Those whose income does not exceed RMB 120,000 annually are not required to file taxes, so if that includes you, you're in the clear this year.

Chaoyang Tax Bureau No. 4 Tax Office (北京朝阳区税务局第四税务所)*

1F, Bldg B, A12 Xidawang Lu, Chaoyang District

朝阳区西大望路甲12号B座一层

*The address listed above is one of the city tax offices for Chaoyang District. Be sure to check with your company's HR on which office to go to, especially if you reside in another district.

READ: When Will Beijing's Dreaded Asterisk* Go Away?

Images: Cindy Marie Jenkins, Unsplash