An All in One Guide About Health Insurance in China (and How to Not Overpay for it)

Health insurance is a sensitive topic for most of us as it is directly related to the peace of mind of the most important pillar in life -- our health. Most foreigners in China are sold more comprehensive plans than they need, are not given enough time to consider alternatives on renewal through their financial agent or a broker, and in general lack knowledge on how private insurance works in the country.

Components of a Health Insurance Policy

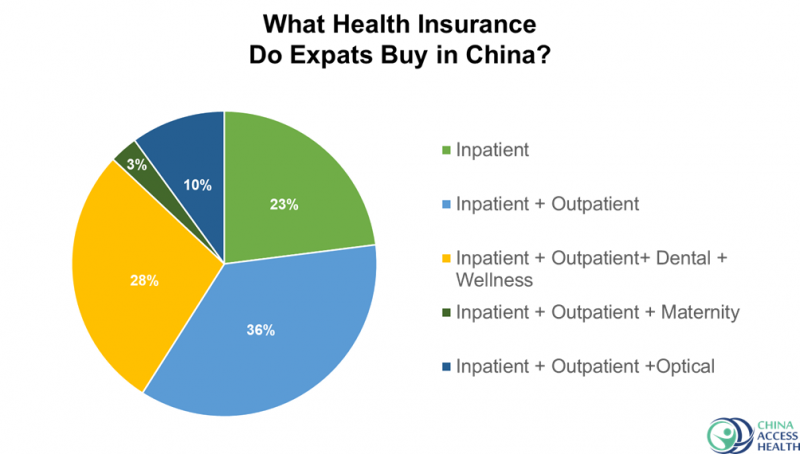

Inpatient-only plans cover major medical bills, emergencies and any treatment that requires you to be in the hospital for more than 24 hours. Those include a range of other expensive treatments, such as cancer treatment, surgeries, most emergency services, medical repatriation and medical evacuation.

Inpatient with Outpatient plans cover outpatient benefits in addition to the plans above. Outpatient is a category for any treatment that takes less than 24 hours to complete. These benefits include routine doctor's visits, prescription medications, physiotherapy, Chinese medicine and diagnostic tests.

Do you know that most insurance providers these days can let you have discounted premium even without making any changes to your coverage level? If your agent/broker hasn’t told you about it, scan QR codes below to request quotes online or talk to a specialist directly so we can help you.

There are optional benefits that can be added to your plan, such as dental, wellness, optical and maternity. Wellness benefits are used for annual check ups, and for some companies cover vaccinations. So what level of cover is most popular among foreigners in China?

What are other considerations that impact the premium of a health insurance policy?

1. Area of coverage. These days most insurance plans can be tailored to cover China only. In most cases you will still be covered outside of the country but only for emergencies.

2. Do you need access to expensive medical facilities? These lists change all the time, historically the most expensive facility -- United Family -- is not considered as a high cost for several companies. The same applies to Parkway Health, Sino United and Global Health in Shanghai, OASIS and Raffles in Beijing. With some companies, Parkway outside of Tier 1 cities (Chengdu and Suzhou for example) is covered as usual, with no need to pay extra to get access.

3. Do you live outside of Tier 1 cities? There are several plans that can give a substantial discount for members living outside of Beijing, Guangzhou or Shanghai. Most people are simply not aware of this and can reduce the price of any plan by 10 percent.

4. Deductibles and copayments. Deductibles (also known as excess) is a set amount that you first pay before your insurance covers any medical bills. Adding a deductible is a simple way to reduce your premium by 10-25 percent, although not every company allows this. Speak with a consultant to know if your plan allows deductibles.

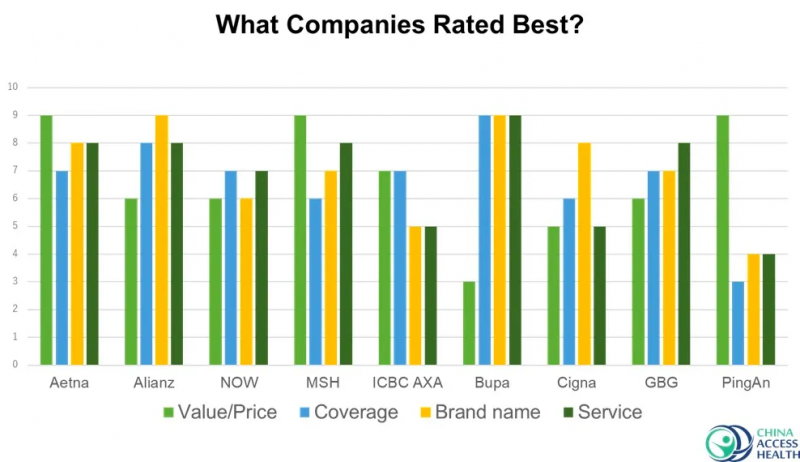

Based on our research, 92 percent of foreigners in China are currently insured or have been insured with one of the companies below. As a licensed insurance broker we have access to every company listed below, and many others as well. It’s important to let our consultants know more about your situation so they can offer the most suitable options.

It’s important to understand that every insurance company has their own standards for underwriting, and the terms offered will vary with each company. With over a decade of experience, China Access Health’s consultants have seen every kind of health condition and know which companies offer the most flexible underwriting. Scan the QR codes below to speak with a specialist and find out if you can receive coverage and get a quote for every major insurance company or even apply for discounted rates on the current plan you have.

The full article is available on the China Access Health website

Images: CGTN, courtesy of China Access Health